Trading the Markets: Indicators

Last time in this series we looked at support and resistance. You can read that here. Let’s go one step further today and learn about indicators.

Indicators help us analyze or predict the movement of an asset. They are created using preset logic involving candlesticks, S&R and other factors. Different types of indicators help in different ways. Some help in buying or selling while some help in predicting or confirming trends.

Indicators can be divided into two categories based on what kind of data is used to create them: lagging and leading. Lagging indicators “lag” the price, meaning they signal the occurrence of a new trend after it has occurred. Leading indicators “lead” the price, meaning they signal the occurrence of a new trend before it has taken place. While leading indicators sound very appealing, many a time they give false signals.

Let’s look at some of the most popular indicators used by traders.

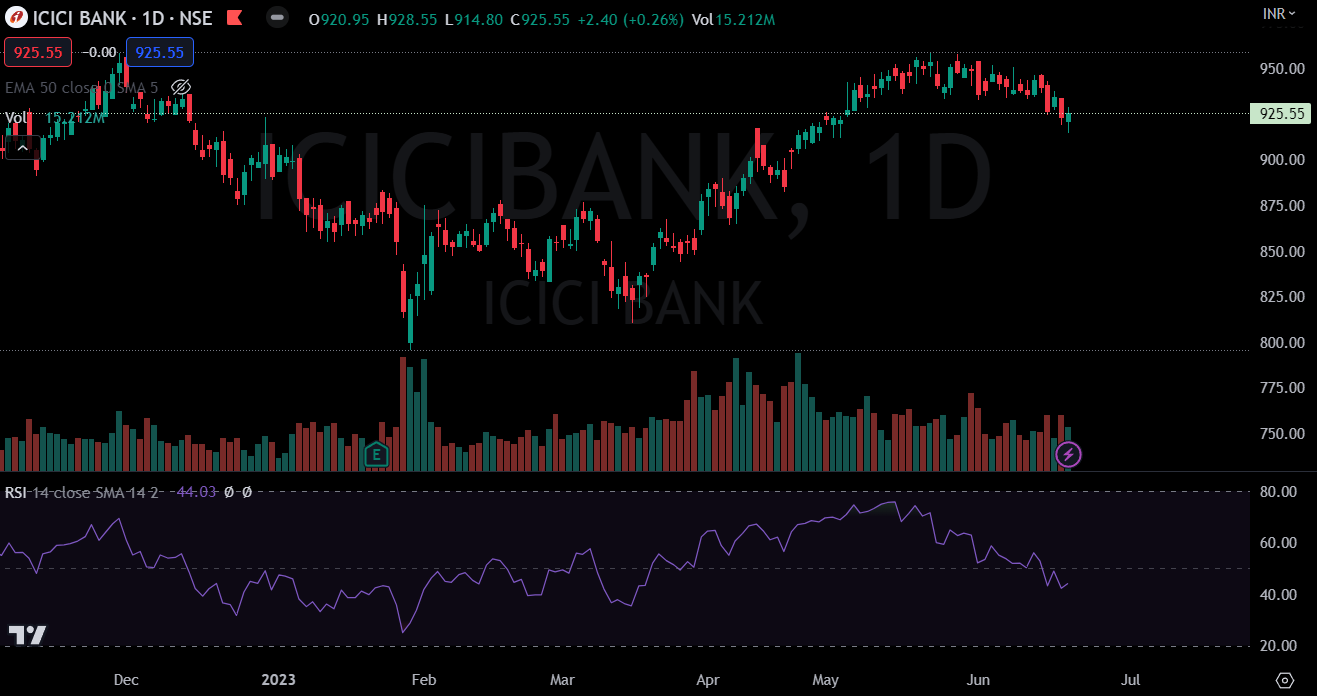

Relative Strength Index (RSI)

This indicator was developed by J Welles Wilder and is a leading indicator used to identify trend reversals.

RSI oscillates between 0 and 100.

The formula goes like this: RSI = 100 - 100/(1+RS) where RS = Average Gain/ Average Loss.

Knowing the formula is well and good but how we use this indicator is that when RSI is at its extremes, we can infer if the asset is oversold or overbought.

When RSI reads between 0 and 20, it could indicate the asset is oversold and when between 80 and 100, the asset could be overbought. (Instead of 20 and 80, 30 and 70 can also be used)

Moving Averages (MAs)

We all know how averages work. Simple Moving Averages (SMAs) are just extensions of that, they consider the data for a specific number of days you need.

MAs are used to identify trends.

They are most commonly calculated using the closing prices, but the high, low and open prices can also be used.

Exponential Moving Averages (EMAs) are a further extension of the concept which give more importance to recent data points rather than the older ones. Therefore, many traders prefer using EMAs over SMAs.

Generally, you should think of buying when an asset starts to go above an upward-trending MA and selling when an asset starts to come below a downward-trending MA.

Moving Average Convergence and Divergence (MACD)

This is a momentum indicator and is one of the most trusted indicators.

Convergence means two MAs moving towards each other while divergence means the MAs are moving away.

The most common method for creating the MACD indicator is using a 12-day and 26-day EMA. We subtract the value of the 26-day EMA from the 12-day EMA to get the value of the MACD, and we get a simple line graph.

When the MACD is positive, it means the 12-day EMA is higher than the 26-day EMA. Therefore the momentum is positive. Remember, the higher the magnitude of the MACD is, the more strength there is in the upward trend. Same logic with negative MACD.

Moreover, the general thinking with MACD is that when the MACD crosses from negative to positive territory, it means there is a divergence between the two MAs. This indicates increasing bullish momentum; therefore, one should look at buying opportunities. Similarly, when the MACD goes from positive to negative, one should look for selling opportunities.

We can also use the 9-day EMA as a “signal line”. Since MACD is a lagging indicator (takes previous data to be formed), you could miss a potential swing. So, using a signal line could help. You simply buy when MACD crosses the signal line on the upside and sell when it goes below the signal line.

As with all things in trading, keep in mind that indicators alone should not be used to form your trading plan. They can complement your views or trading system and then be used effectively. There are a lot of signals given by each and every indicator and many are false, mainly because the information given by indicators is known to everybody and if everyone knows about it, the edge is gone.

That’s it for this article on indicators. We’ll talk more about technical analysis in a later article. Subscribe for free to receive new posts and support my work. And do let me know if you want a specific topic covered!

P.S. You can read all my articles here.