Trading the Markets: Candlestick Patterns (Part 2)

I introduced candlestick patterns yesterday, you can check that out here. So let’s continue from where we left off - Multiple Candlestick Patterns.

Patterns involving multiple candlesticks are more reliable than standalone candles since you have more than one factor for you to confirm the possible direction of price movement. By the same logic, patterns with 3 candles would be more reliable than the ones with 2 within multiple candlestick patterns.

So let’s check out some common patterns. (I have attached an example at the bottom of the article if my theoretical explanations aren’t as clear as I’d like)

The Bullish Engulfing Pattern

Let’s break this down into 2 parts. “Bullish” means the pattern is expected to give a bullish movement afterwards and “Engulfing” means that the bullish candle has engulfed or taken over the bearish candle, hence changing the trend from bearish to bullish.

The Bearish Engulfing Pattern

Same exercise, “Bearish” means the pattern is expected to give a bearish movement afterwards and “Engulfing” means that the bearish candle has engulfed or taken over the bullish candle, hence changing the trend from bullish to bearish.

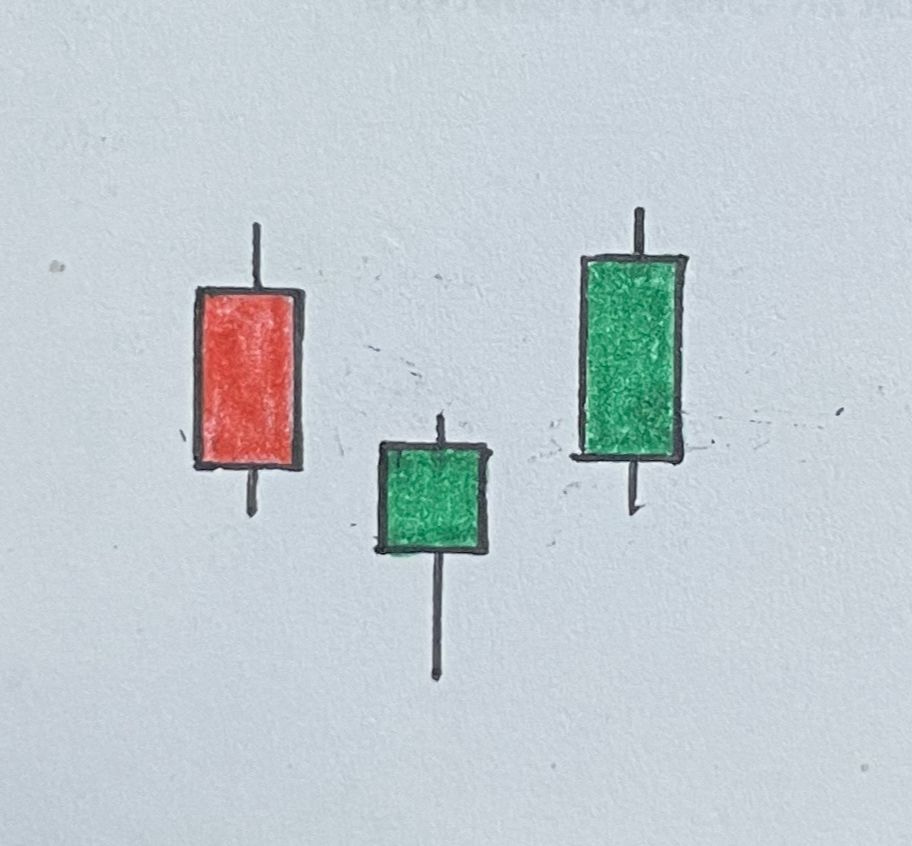

The Morning Star Pattern

This is a 3-candle pattern which is expected to change the trend from bearish to bullish. The first candle would be a red one, the second one can be a doji or a spinning top and the last one completing the pattern would be a bigger green candle. In the absence of the second candle, this would have been the bullish engulfing only. You would now understand the psychology behind this pattern easily: after the downward push, buyers came back in during the second candle and then overpowered sellers eventually during the third candle leading to a bullish push afterwards.

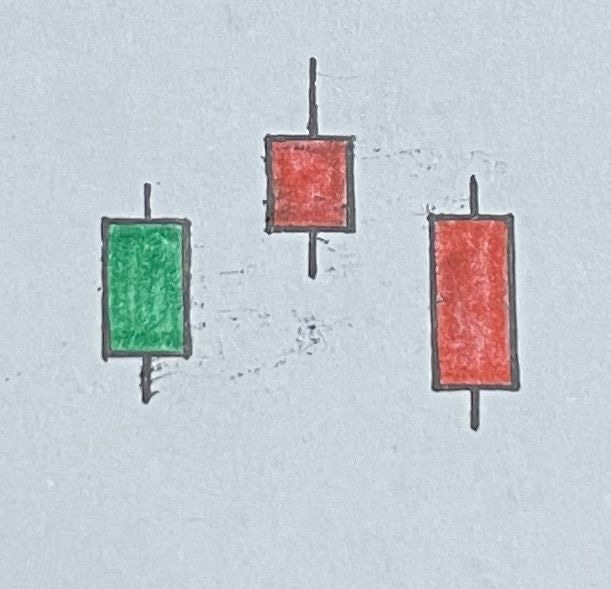

The Evening Star Pattern

This is the exact opposite of the morning star pattern. The first candle would be a green one, the second one would be a doji or a spinning top and the last one completing the pattern would be a bigger red candle. You would now understand by yourself, the logic and psychology behind the expected downward push after an evening star is formed.

There are myriad types of patterns with confusing names. The point of these 2 articles was to make you understand the psychology of the market when any pattern forms. Moreover, always remember that actual patterns in the market would not be so perfect, you would always have to make considerations. Let’s see this through the example below. We’ll take the same chart from yesterday for consistency.

As you can see, the patterns in the chart are far from perfect. Also, the movement afterwards is not as clean as we would like. Fluctuations are a part of the markets and the movements in any direction are never in one straight line (almost never!).

Hopefully you can understand all the patterns in the chart from all I’ve told you about them. That’s it for candlesticks. You can explore charts on your own at https://in.tradingview.com/.

Subscribe for free to receive new posts and support my work. And do let me know if you want a specific topic covered!

P.S. You can read all my articles here.