The Company that owns it ALL

India recently became the 5th largest economy in the world, the latest GDP number for the country was more than $3 trillion. Above that stand in 3rd and 4th place, Japan and Germany, both of which have a GDP greater than $4 trillion. We’re talking about TRILLIONS here. Now that you understand the scale we’re talking about, there is a company which has around $10 trillion in Assets Under Management. To put it into context, only the USA and China have a GDP greater than that number.

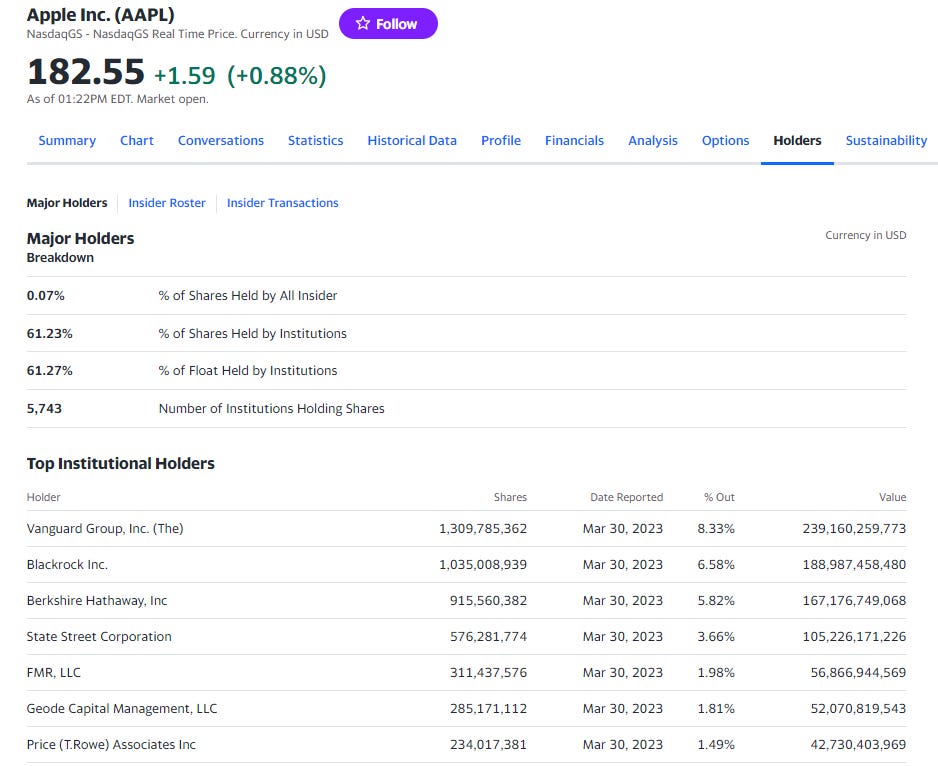

The company we’re talking about is named Blackrock, Inc. and it is one of the top shareholders in most companies in the US. It also holds significant stakes in companies all around the world too through dedicated funds. You can check it yourself (easiest place is Yahoo Finance), but just to show it quickly there’s a few examples below.

Every economy is dependent on the banks of the respective country. When a company is a significant stakeholder in all of the banks, literally every company that could make a difference, you can imagine the kind of power and influence it can hold. More so the information that the company would have access to.

You might see brands in the same industry fighting over market share. For example, Coca-Cola and Pepsi or JP Morgan and Citi. But if a company holds a stake in all of the competitors that you see fighting over you, it doesn’t really matter what company you use, Blackrock benefits from it.

The company also owns most of the media you consume. From news outlets to movie producers, so we most probably are directly influenced by their decisions or thinking without knowing about it.

But keep in mind that the company itself is not a shareholder. The owner of all the securities/assets are the clients through their investments made on their behalf via funds managed by BlackRock. But as shareholders, BlackRock can vote on behalf of their clients at shareholder meetings and they might not represent the clients’ preferences.

The company serves a number of government entities like treasuries, apart from companies, investment firms, other investors and tax-exempt entities like NGOs, etc. too. It has clients in more than 100 countries. The firm offers single and multi-asset class baskets that buy stocks, fixed income, options, and money market funds to all its clients. BlackRock makes its money by offering a host of portfolio advising and asset management-related services.

I’m not saying this is a sinister organization, just highlighting the impact that this one single company has on the entire world economy. In fact, the company, under CEO Larry Fink, created an advanced trading algorithm named Aladdin (short for Asset, Liability, Debt, and Derivative Investment Network) which according to reports single-handedly stopped the world from experiencing a financial collapse in 2008.

The algorithm apparently executes 250K trades per day on average. It collects data points on every market, every company, and every asset, and uses machine learning to calculate which trades to make faster than we can blink our eyes. I said before that this may not be a sinister organization. But if this network ever were hacked, or went into the wrong hands, there sure is a potential for this to create havoc in the financial system of the world, since it is so sophisticated that governments and banks use its services. Just something to think about.

That’s it for this article. Subscribe for free to receive new posts and support my work. And do let me know if you want a specific topic covered!

P.S. You can read all my articles here.