The Cash Flow Statement

The Cash Flow Statement is important to analyse a business because it helps us check the inflow and outflows of cash during a given time period. This information is needed to check the optimum short-term and long-term cash levels to run the business.

All activities conducted by a company come under one of these three categories:

Operational activities: The activities done under the core business of the company are included in this category. For example, an IT company has tech development, hiring, marketing, sales, business development, etc. in their day-to-day activities.

Investing activities: These activities consist of investing done by the company in different types of assets, from bonds and equities to land and factories. These activities are done with the goal of availing benefits or profit in the future.

Financing activities: The activities conducted by the company relating to all financial transactions, like sending dividends to shareholders, payment of interests, raising new debt, etc.

Now that you know the types of activities that make a company gain or lose cash, let’s understand how the cash flows when assets and liabilities come and go. Let’s take 4 examples.

Issuance of new shares - financing activity - the cash balance would increase - increases liability on the company (We’ll talk about this when we talk about Balance Sheets)

Buying land for new factory - investing activity - the cash balance would decrease - assets increase

Expenditure on the painting of an office - operating activity - the cash balance would decrease - treated as an asset (since it is required for working of the company)

Old debt is paid off - financing activity - the cash balance would decrease - liability also decreases

So, whenever assets increase, cash decreases and vice-versa. And whenever liabilities increase, cash increases and when they decrease, cash decreases.

Now that we understand what makes the cash increase or decrease, let’s look at a company’s Cash Flow Statement. Keep in mind, Net Cash Flow = Cash flow from operating activities + Cash flow from investing activities + Cash flow from financing activities.

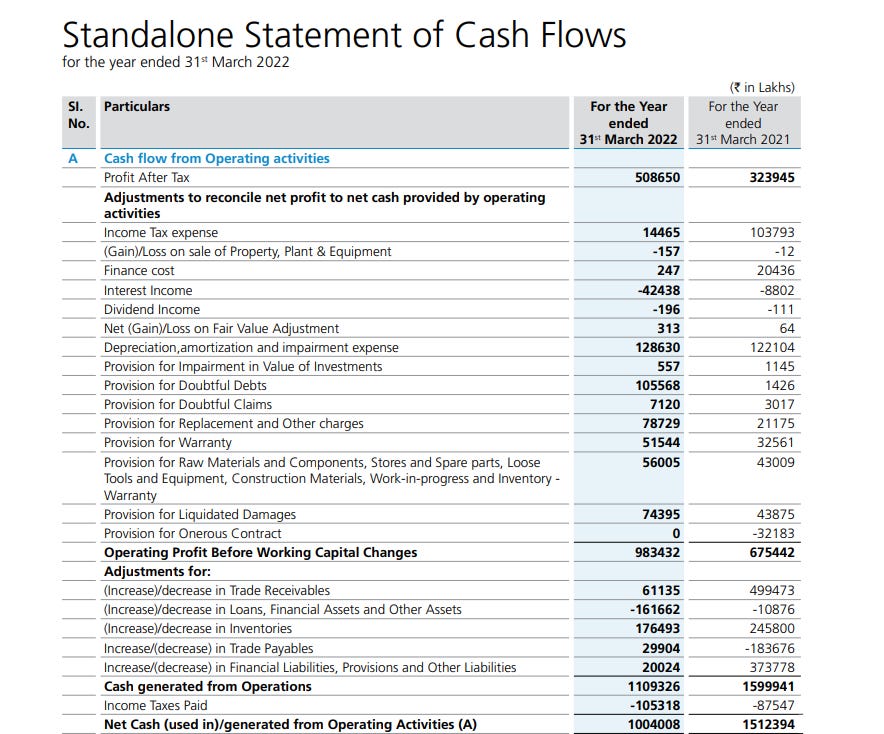

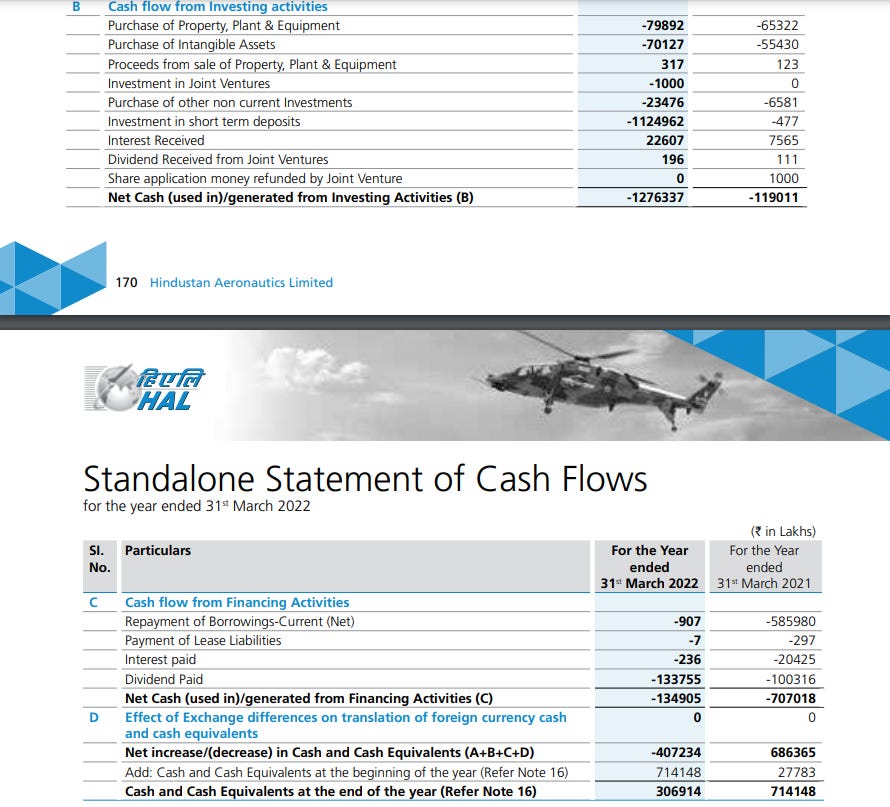

If the Net Cash Flow is positive, the company gained cash in that financial year and if it is negative, the company lost that amount of cash. Look at the example below for a real-world example. This is the cash flow statement for Hindustan Aeronautics Ltd for FY 2022.

A concise view would look something like this.

You can see the figures for FY 2021 and FY 2022 and match them from the cash flow statements above. The net change in cash is also reflected in the company’s assets since cash is a liquid asset (liquid means it can be exchanged easily). See below.

I’ll cover more about assets and liabilities in an article about the Balance Sheet of a company. But that’s it for this article. Hope you learnt something.

Subscribe for free to receive all new posts and support my work. And do let me know if you want a specific topic covered!

P.S. You can read all my articles here.